MBA. Hellen Ruiz Hidalgo

Strategic Communicator

OCEX-UNED

Level of contagion, health containment measures, state socio-economic support, and financing of the public sector

1. Level of infection

On March 6, 2020, the first two cases of covid-19 were confirmed in Costa Rica. The case was a US tourist, whose partner had contact with a confirmed case in the United States. On 20 March, the woman, as well as her husband, were discharged and allowed to return to their country of origin.

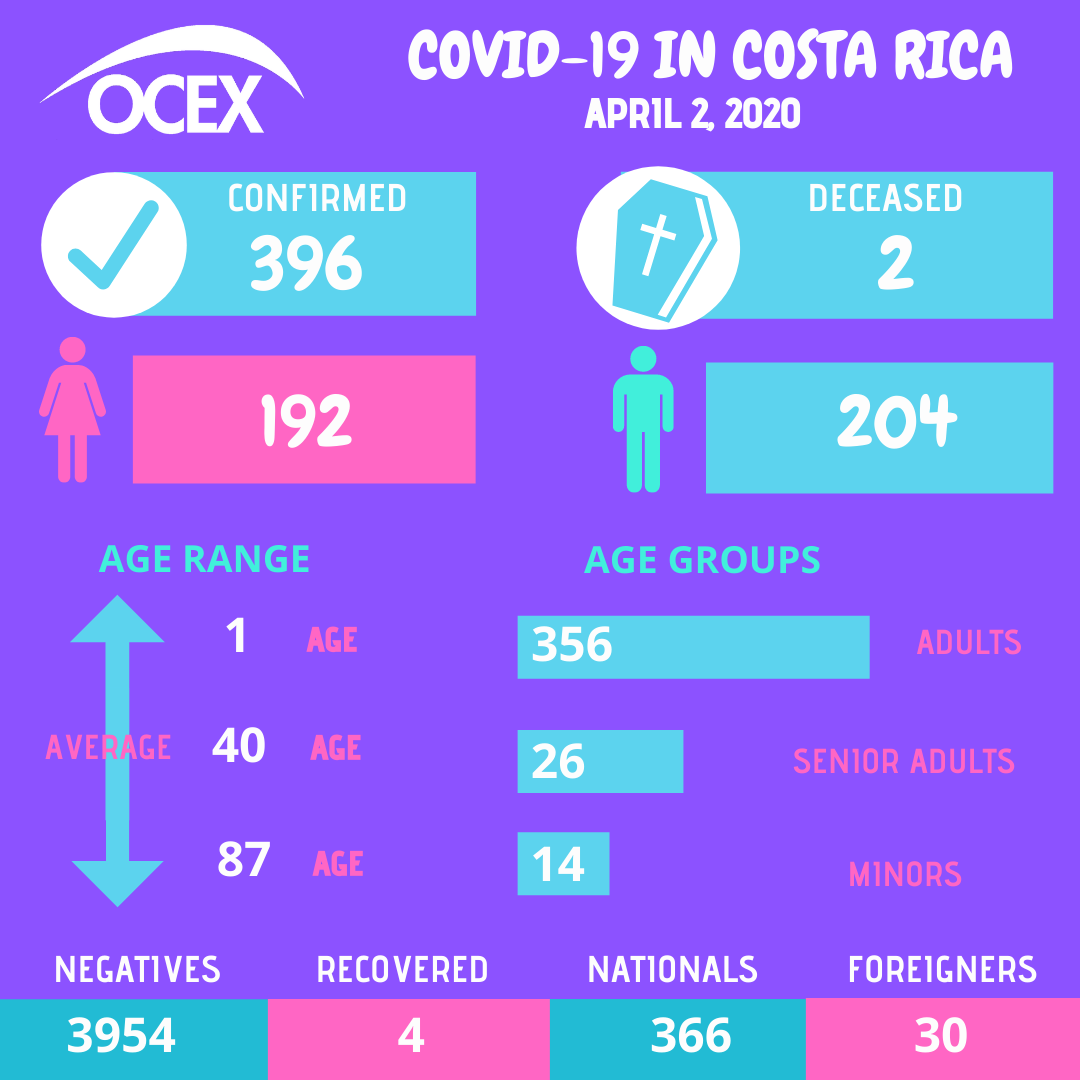

As of April 2nd, 396 cases of the virus had been reported. The statistics include two fatalities, both 87-year-old male patients. The first death occurred on Wednesday, March 18. It was a retired doctor, a resident of Alajuela, who also suffered from hypertension. On the night of Thursday 19 March, the Ministry of Health confirmed the second death. In figures this is our state of affairs as of April 2nd, 2020. See infogram below:

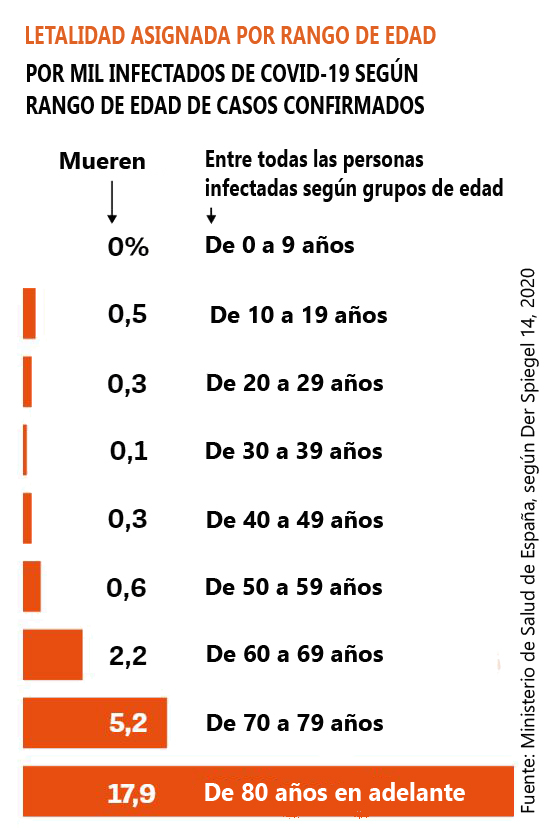

Mortality likelihood by age

According to official data from the Spanish Ministry of Health, as of March 22, 2020, on the basis of 18959 confirmed cases of infected persons (805 of whom died), the prestigious German magazine Der Spiegel published, on Friday March 27, the following table of mortality by age of the covid-19.

2. Measures in Costa Rica for health containment, state socioeconomic support and financing of the treasury

On 7 March 2020, the Government of Costa Rica took measures to contain the speed of the pandemic's spread. These measures have increasingly focused on social contact restrictions aimed at reducing the rate of growth of infections, especially by reducing the number of serious cases, patients in need of hospital support or intensive care, so as not to compromise the capacity of the health system.

These measures had significant negative consequences on the economy, with a detrimental social impact on both the affected populations and vulnerable social sectors. For that reason, the Government has also proposed and decided on a plan for the socio-economic mitigation of the negative impacts on different economic activities and on the population in general.These measures had significant negative consequences on the economy, with a detrimental social impact on both the affected populations and vulnerable social sectors. For that reason, the Government has also proposed and decided on a plan for the socio-economic mitigation of the negative impacts on different economic activities and on the population in general.

These measures seek to protect employment and free up money for companies and individuals so that they can have "cash flow" in the coming weeks, which will be overwhelmed by the uncertainty caused by the Covid-19.

In this regard, we recommend watching the interview with Ms. Pilar Garrido, Minister of National Planning and Economic Policy, in the program "Enfoques crhoy", on Monday, March 30, 2020. The link below is: (Entrevista a Ministra Pilar Garrido.)

A). Actions to contain the spread of Covid-19

On Monday, March 30, 2020, the Government of the Republic, in view of the rapid expansion of covid-19 and to minimize the impact on the most vulnerable sectors, decreed 56 measures that derive from the Social Protection Roundtable coordinated by the Joint Institute of Social Assistance (IMAS), but which involves institutions such as MCJ, DGME, Vice-Ministry of Dialogue, MIVAH, DESAF, MEP, PANI, REDCUDI, INAMU, MTSS, CCSS, INA, CONAPAM, CONAPDIS, IAFA, JPS, Ministry of Health, Ministry of Human Development and Social Inclusion and the Municipality of San José.

These measures include the social protection of different populations of high-risk groups such as minors, women in vulnerable conditions, people with disabilities, older adults, indigenous people, homeless people and families in poverty. The following link provides details of these measures: (respuestas-en-materia-de-proteccion-social/)

The President of the Republic, Carlos Alvarado, and the Minister of Health, Daniel Salas, presented on Monday, March 30th to the Legislative Assembly the bill to increase the fines against people who violate the health measures adopted by the State.

To set the fine, the monthly base salary of "Oficinista 1" should be used, which for this year 2020, is set at 450,200 colones. A person diagnosed with covid-19 who violates his isolation order will be fined 5 salaries (2.3 million colons).

OCEX is offering you, as of April 2nd 2020, a recount of the new temporary measures instructed by the government as of 8th March, the day the national yellow alert was declared.

8th March

- Ministry of Health recommends postponing trips abroad.

10th March

- Guidelines for the implementation of teleworking for public institutions are instructed.

- The Reverend Francisco Schmitz School in El Porvenir de Desamparados and the Colegio Técnico Profesional Máximo Quesada, Monseñor Rubén Odio, El Nocturno de Desamparados and Blue Valley are closed.

11th March

- Public universities are suspending in-person classes and asking professors to teach them through virtual platforms.

12th March

- Events and activities of mass concentration are cancelled.

- Meeting space is reduced to 50% of its capacity.

- The preventive closure of educational centers where there are educators who test positive for the disease, who have children in other educational centers; and centers that do not have a supply of drinking water and cannot be provided by other means are ordered.

13th March

- Lessons are suspended in 344 schools.

- Line 1322 is activated for consultations.

14th March

- Costa Rica's Post Office and the National Liquor Factory (Fanal) will enable the online platform to distribute antiseptic alcohol throughout the country.

15th March

- Bars, discos and casinos (nightlife) are ordered to be closed.

- They must operate at half capacity or restaurants, sodas, bar-restaurants and food courts will be closed.

16th March

- A state of national emergency is declared and the school year is suspended.

- It is announced that only Costa Ricans may enter from abroad.

17th March

- Protocol for the attention of vessels and persons in Puerto Caldera by INCOP. (Available at https://bit.ly/2WwPDbN).

- The facilities of the National Rehabilitation Center (CENARE) will be used to care for patients infected by covid-19.

- The men's soccer championship is suspended.

- The closure of national parks is announced.

18th March

- Temporary suspension of the vehicle restriction for cargo vehicles. (Valid until April 30th). Directive 2020-000324 MOPT (Available at https://bit.ly/2WymDAz).

- Extended coverage for covid-19 testing.

19th March

- Authorization for companies under the Free Zone Regime to move computer equipment and furniture necessary for their employees to telework. Circular-DGA-006-2020 National Customs Service. (Available at https://bit.ly/2vFwVUp).

- Activation for the emission of digital shipments by the Captaincy of the Port of Limón.

- Restriction for the entrance of foreigners by sea, air and land (not applicable for merchandise transport and other exceptions). (Valid until April 12). (Directive DGA-004-2020).

- Closure of cinemas and theaters during the weekend was ordered.

20th March

- Temporary acceptance of copies for the documental and physical verification at the customs. Valid until the national emergency is maintained. Guideline DGA-004-2020. Directriz DGA-004-2020 (Available at https://bit.ly/2WymXiL).

- The Ministry of Justice ordered the immediate suspension of visits to all prisons in the country until further notice.

- The Ministry of Public Education (MEP) will deliver food packages to school cafeterias.

23th March

- Toll workers are required to wear a mask and gloves, and the Ministry of Health has published a list of measures that commercial networks, supermarkets and suppliers (mini-supermarkets) must comply with.

- UNED, SINART and MEP announced their "Aprendo en Casa" (I learn at home) program to provide guidance, specific guides and support resources to the national educational community.

- The plan brings together actions for teachers, students and families.

- Ministry of Health orders to close business at 8pm on weekends.

24th March

- Vehicles will not be allowed to circulate from Monday to Thursday from 10pm to 5am and from Friday to Sunday from 8pm to 5am, with the exception of home deliveries of medicines and food. Those who do not comply are exposed to a traffic fine of ₡22.187,93 up to ₡107.000 colones.

- CCSS, Correos de Costa Rica and Budget Car Rental form an alliance to make available 40 vehicles for home delivery of medicines.

- Total closure of beaches until further notice.

- Obligatory closing of churches, temples or cults of any denomination.

- All foreign residents in the country and refugees who leave the national territory will lose their immigration status.

30th March

- The Supreme Electoral Tribunal (TSE) will remain closed until 12 April. All other services must be processed through the website.

31th March

- National sports games are postponed to next year 2021.

- The Public Force is accredited to issue traffic fines. Law regulations approved.

B). Socio-economic support actions by the State

This is a list of the Government's socioeconomic support actions for people and sectors affected by the health containment measures of the pandemic:

|

Social Security |

|

|

Ministry of Labor |

|

|

Central Bank, |

|

For further details, we provide you with a summary of the measures announced by each bank, March 21. Download the summary at the following link: (medidas-anunciadas-por-los-bancos-ante covid-19).

|

Logistics Commercial

|

|

|

Taxes and incomeTaxes |

|

|

National |

|

|

Electricity and water |

|

|

Other measures of |

|

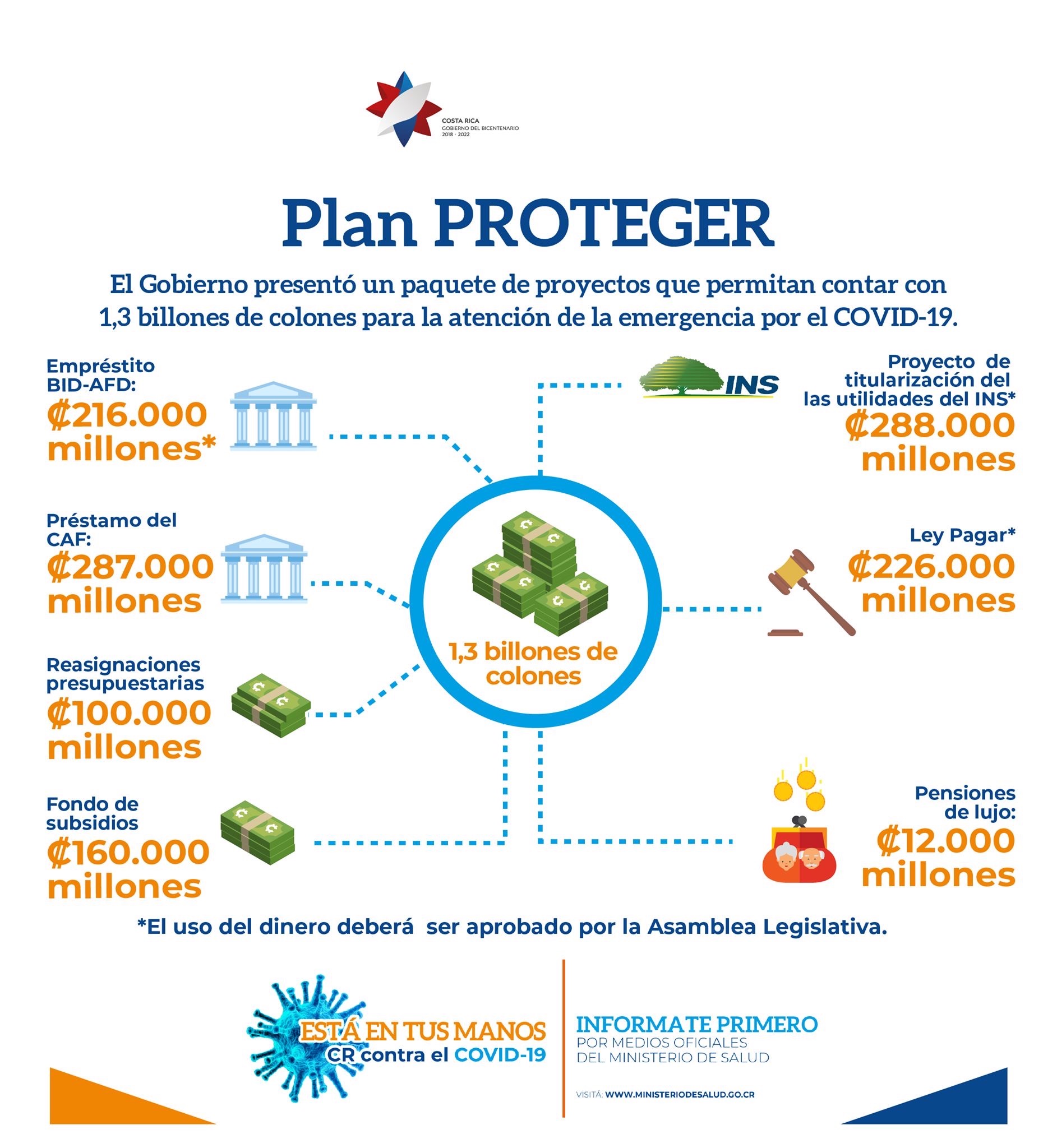

C. Accions of support and financing of the treasury

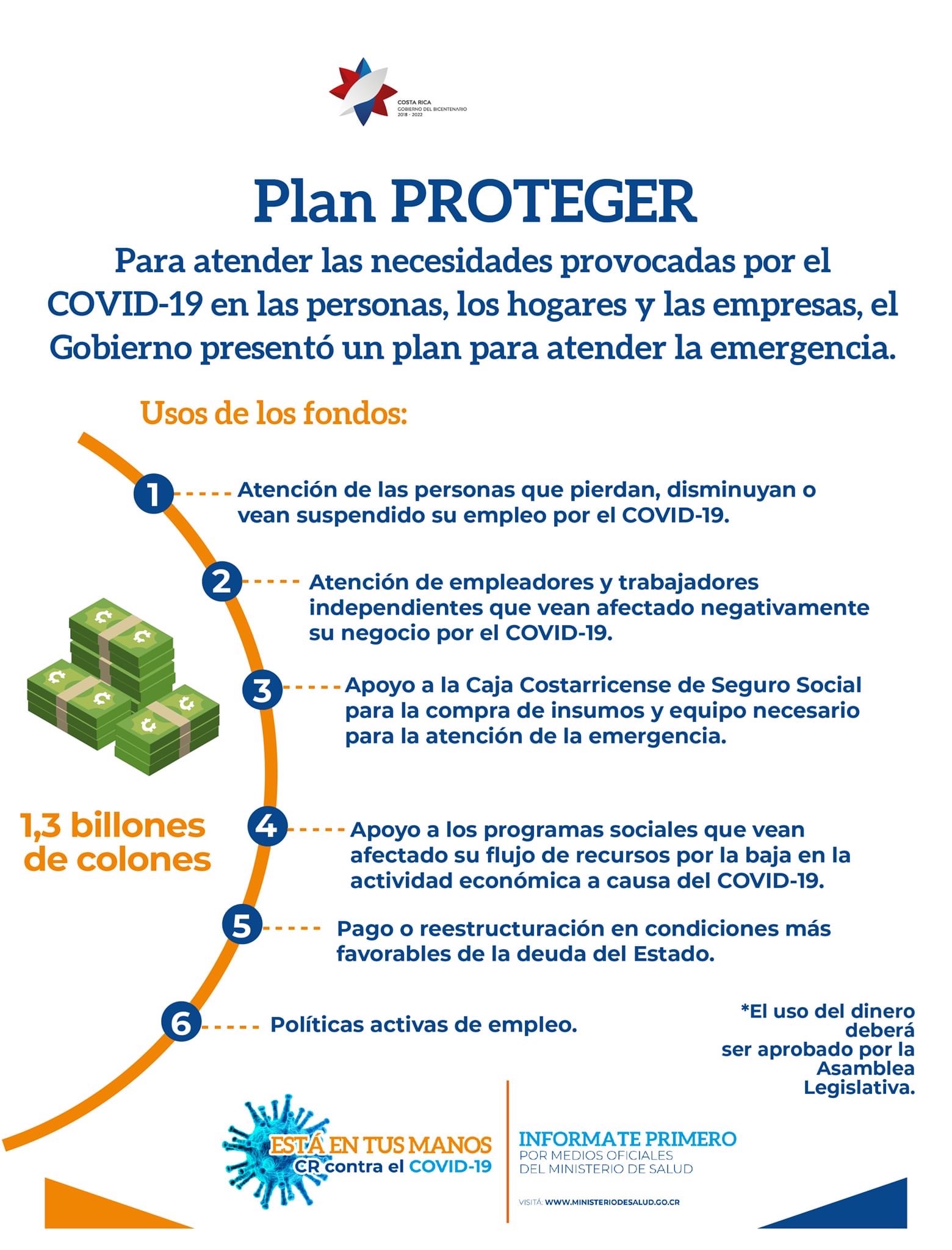

PROTEGER" Plan: With the objective of accumulating liquidity to protect people, jobs and companies, the Government of the Republic created the "PROTEGER" Plan that reaches the amount of ₡1 billion.

These funds will be allocated:

- To people who lose, diminish, or see their employment suspended by covid-19.

- To employers and independent workers who see their businesses affected.

- To the CCSS for the purchase of inputs and equipment (at least ₡33 billion to amortize the reduction of contributions by the CCSS).

- To social programs that affect their flow of resources.

- To the payment or restructuring in more favorable conditions of the State's debt.

- To active employment policies.

In order to have financial access to public funds for financing the State's socioeconomic relief actions, special public financing initiatives have had to be used, such as:

- Reduction of budgeted state expenditures.

- Reallocation of resources from decentralized entities.

- It was announced that, eventually, solidarity support from employees would also be resorted to.

|

|

|

Other state funding measures include the following:

8th March

- A yellow alert is declared to release funds from the National Emergency Commission, thus activating thematic operational tables, allowing the mobilization of resources on an inter-institutional basis and convening the Emergency Operations Center (COE) twice a day.

9th March

- Foreign travel by public officials is suspended.

24th March

- Government suspends annual salary increase for public employees.

- Approved by the Andean Development Corporation (CAF) Borrowing Congress (₡287 billion or $500 million).

- Solidarity contribution of luxury pensions (₡12 billion), (pending formalization in Congress).

- “Ley Pagar” "Pay Act" (₡226 billion).

- The non-reimbursable cooperation credit from the Central American Bank for Economic Integration (CABEI) of $1 million will be destined exclusively to the National Emergency Fund.

- Loan from the Inter-American Development Bank (IDB)-French Development Agency (AFD) (₡216 billion).

- Securitization or donation of the profits of the National Insurance Institute (INS) (₡288 billion), this amount will go exclusively to the National Emergency Fund.

- Assignment of surpluses from eleven public entities (₡266 billion).

The detail of the amount per entity in figure 1 below:

|

|

Final conclusions

The president indicated that the members of the economic team of the government are working on the promotion of a series of projects in the legislative agenda and extended a patriotic thanks to the deputies who have been willing to meet from Friday to Sunday to move forward with the actions.

"We have the liquidity to finance a series of measures that would have the fundamental objective of protecting people, jobs and companies. These resources give us the necessary protection as a country to be able to deal with this social and economic emergency, which is why we are asking the deputies for their support," said the president, while expressing his administration's willingness to work as a team for the country.

Readings consulted:

- La Nación. 25 de marzo 2020. Recuento gráfico de la evolución del covid-19 en Costa Rica:

https://www.nacion.com/gnfactory/especiales/2020/Covid19/index. - COMEX.25 de marzo 2020. Medidas covid-19 al 21-03-2020:

http://www.comex.go.cr/media/8066/medidas-covid-19pdf-1.pdf - El Financiero. 24 de marzo 2020. Estos son los 20 cambios que aplicó el gobierno para ayudar a las empresas y personas frente al coronavirus:

https://www.elfinancierocr.com/economia-y-politica/estos-son-los-20-cambios-que-aplico-el-gobierno/ - Delfino.cr. 22 marzo 2020. Cronología covid-19 al 22 de marzo 2020:

https://delfino.cr/2020/03/covid-19-en-costa-rica - Cápsula OCEX #3-2020. 26 de marzo 2020. Impactos del covid-19 en el comercio nacional y mundial: https://www.uned.ac.cr/ocex/index.php/capsulas/558-capsula-3-2020-impactos-del-covid-19-en-la-economia-costarricense-y-mundial

- El Financiero. 21 -27 de marzo 2020. Superávits financiarían la moratoria tributaria: https://www.elfinancierocr.com/economia-y-politica/superavits-de-once-entidades-ayudarian-a-financiar/

- Delfino.cr. 27 de marzo 2020. JPS lanza subsidio de 200mil colones para vendedores de lotería afectados por covid-19: https://delfino.cr/2020/03/jps-lanza-subsidio-de-200-mil-colones-para-vendedores-de-loteria-afectados-por-covid-19

- La Nación. 24 de marzo de 2020. Plan autorizaría entregar FCL a los trabajadores afectados: https://lanacioncostarica.pressreader.com/la-nacion-costa-rica/

- La Nación. 28 de marzo 2020. Siete aseguradoras privadas activan atención del covid-19 en sus pólizas de salud: https://www.nacion.com/economia/consumo/siete-aseguradoras-privadas-activan-atencion

- La Nación. 24 de marzo 2020. Con 47 votos a favor, diputados aprueban financiar 110.000 pensiones para adultos mayores en pobreza: https://www.nacion.com/el-pais/politica/con-47-votos-a-favor-diputados-aprueban-financiar/

- Comunicado Casa Presidencial. 23 de marzo 2020. MEP lanza estrategia aprendo en casa: https://www.presidencia.go.cr/comunicados/2020/03/mep-lanza-estrategia-aprendo-en-casa/

- Comunicado Casa Presidencial. 23 de marzo 2020. CCSS, Correos de Costa Rica y Budget car rental se unen para entregar medicamentos a domicilio:https://www.presidencia.go.cr/comunicados/2020/03/ccss-correos-de-costa-rica-y-budget-car-rental-se-unen-para-entregar-medicamentos-a-domicilio/

- La Nación. 23 de marzo 2020. 295 contagiados por coronavirus: Salud ordena cerrar negocios a las 8pm los fines de semana: https://www.nacion.com/el-pais/salud/nuevas-medidas-por-coronavirus-ministerio-de/

- Teletica.com. 30 de marzo 2020. Bancos acordaron periodos de tres hasta 12 meses para que clientes no paguen sus cuotas: https://www.teletica.com/253689_bancos-acordaron-periodos-de-tres-y-hasta-12-meses-para-que-clientes-no-paguen-sus-cuotas

- Ameliarueda.com. 30 de marzo 2020. ¡A cuidar la cédula! Servicio del TSE estará cerrado durante las próximas dos semanas: https://www.ameliarueda.com/nota/a-cuidar-la-cedula-servicio-estara-cerrado-durante-las-proximas-dos-semanas

- Comunicado Casa Presidencial. 27 de marzo 2020. Organizaciones sociales que apoya la JPS se preparan ante covid-19: https://www.presidencia.go.cr/comunicados/2020/03/organizaciones-sociales

- Delfino.cr. 21 de marzo 2020. Estas son las medidas anunciadas por los bancos para sus clientes ante la pandemia de COVID-19: https://delfino.cr/2020/03/estas-son-las-medidas-anunciadas-por-los-bancos

- Delfino.cr. 31 de marzo 2020. Ya entró a regir reglamento que permite a Fuerza Pública hacer multas de tránsito: https://delfino.cr/2020/03/ya-entro-a-regir-reglamento-que-permite-a-fuerza-publica-hacer-multas-de-transito

- Delfino.cr. 31 de marzo 2020.Gobierno propone multas de hasta 2.3 millones a quienes violen aislamiento sanitario: https://delfino.cr/2020/03/gobierno-propone-multas-de-hasta-2-3-millones-a-quienes-violen-aislamiento-sanitario

- Comunicado Casa Presidencial. 31 marzo 2020. Aplazan juegos deportivos nacionales 2020 para próximo año: https://www.presidencia.go.cr/comunicados/2020/03/aplazan-juegos-deportivos-nacionales-2020-para-proximo-ano/

- Comunicado Casa Presidencial. 31 marzo 2020. Gobierno presenta medidas de primera respuesta en materia de protección social: https://www.presidencia.go.cr/comunicados/2020/03/gobierno