|

MBA. Hellen Ruiz Hidalgo

Strategic Communicator, (OCEX-UNED)

Coronavirus in Latin America: economic, social and productive outcomes

The Foreign Trade Observatory (OCEX) presents in this "informative capsule" the consequences of the health crisis in Latin America. We will pay special attention to the fiscal, social, productive and economic outcomes.

In our account, we will draw extensively on some of the most relevant conclusions of the "Economic Survey of Latin America and the Caribbean 2020: main determinants of fiscal and monetary policies in the post-pandemic era of COVID-19", authored by the Economic Commission for Latin America and the Caribbean (ECLAC). We will focus on the economic, social and productive effects resulting from the pandemic and on the decisive factors of these outcomes for public policies in the coming years

Since the outbreak of the coronavirus, as a global pandemic, the concern of the Latin American region was focused on preventing mass deaths, containing the number of those infected, and providing hospital treatment without exceeding the installed capacities of the health systems. This concern, focused primarily on health issues, led to the requirement to undertake drastic measures of social distancing, which would eventually mean the almost total paralysis of all economies in the world.

Latin America is facing a triple challenge in Latin America, the policies of adjustment and relief of the health impacts of the pandemic had, have and will have great repercussions on the economic order, and it is probably this aspect that will dominate the policy agenda of Latin American countries in the coming years.

To understand the scope of the economic condition resulting from the health crisis, it is important, first of all, to bear in mind that Latin America was just emerging from another widespread economic crisis, consequential of the financial crisis of 2008, which has been called the "subprime crisis", because it arose from the financial problems derived from the widespread insolvency of high-risk mortgages, which had become a gigantic real estate bubble that, when they fell into insolvency, affected the entire international financial system and resulted in the biggest world recession since the Great Depression of 1929. More information at: Problems of credit insurance and risk rating agencies.

At this time, all tax systems were forced to implement counter-cyclical policies that involved heavy expenditure by the treasury, leaving Latin America's public finances in a particularly vulnerable state.

The most relevant negative outcomes are going to be slow economic growth, worsening inequality and a higher level of poverty resulting from widespread unemployment. The magnitude of these impacts constitutes, in the words of ECLAC, "the worst crisis in 100 years”.

The worst crisis in 100 years

The most relevant negative outcomes are going to be slow economic growth, worsening inequality and a higher level of poverty resulting from widespread unemployment. The magnitude of these impacts constitutes, in the words of ECLAC, "the worst crisis in 100 years”.

In her presentation, which we are presenting here, specialist Alicia Bárcena, ECLAC's Executive Secretary, explains that the best way to describe the current severity is through its impact on the personal wealth of Latin Americans, with widespread impoverishment.

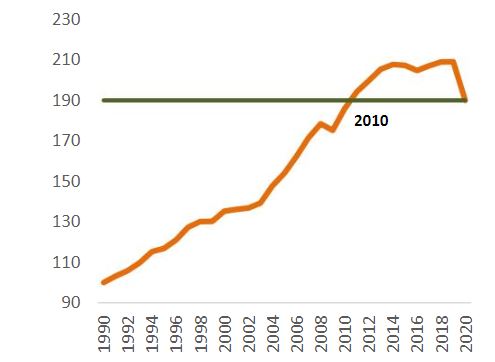

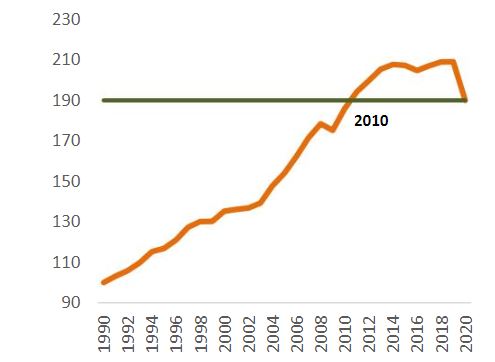

By the beginning of 2021, Latin America's per capita gross domestic product (GDP) will, on average, have fallen back to the levels it had 10 years earlier. Thus, once again, the well-known wedge of a "lost decade" is retaken, the same understanding that was held in the 80s of the last century and that has a wide glossary of long term implications.

|

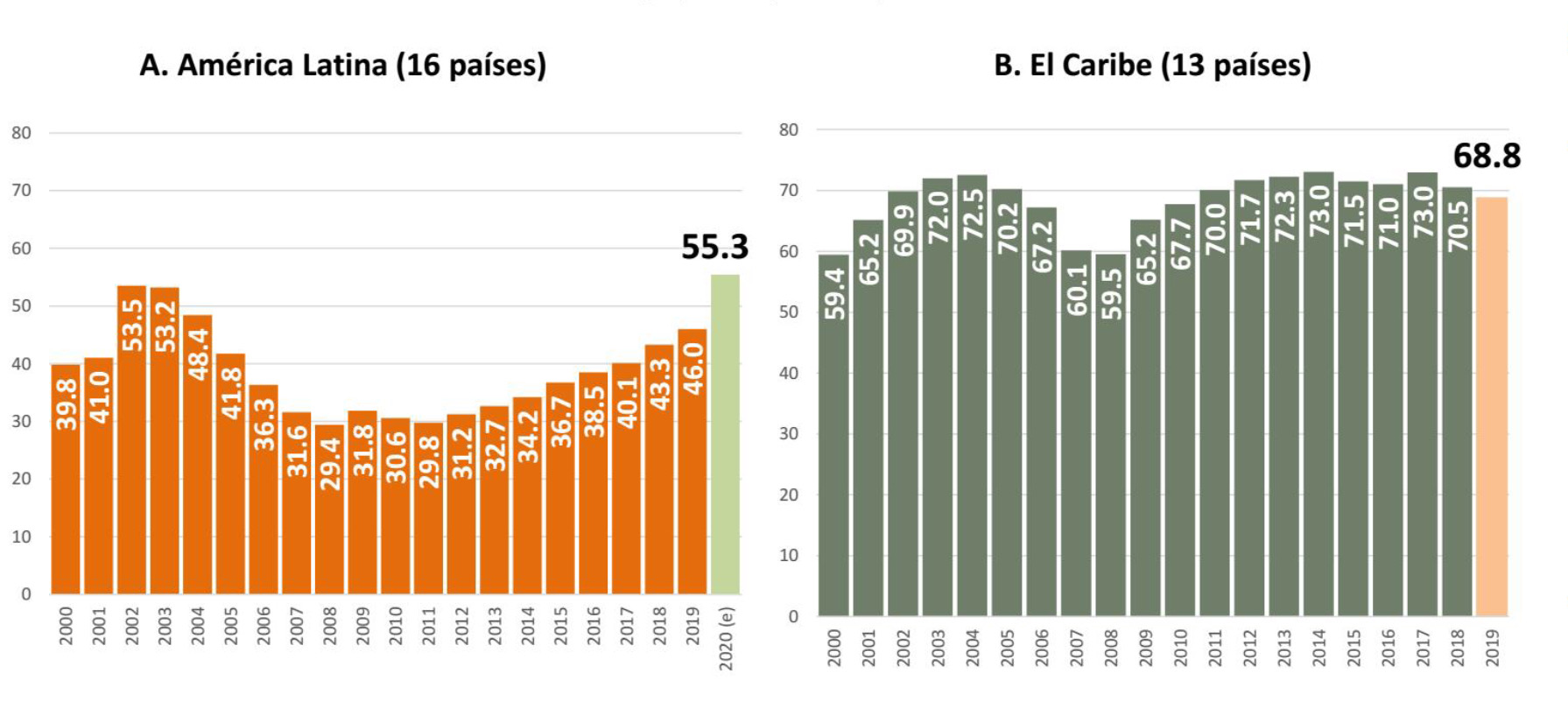

LATIN AMERICA AND THE CARIBBEAN

EVOLUTION OF THE GDP

(Index 1990=100)

|

Source:Economic Survey of Latin America the Caribbean (ELAC).Year 2020.

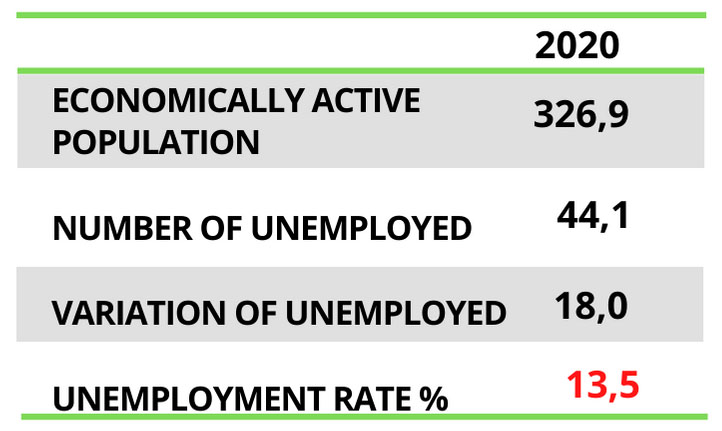

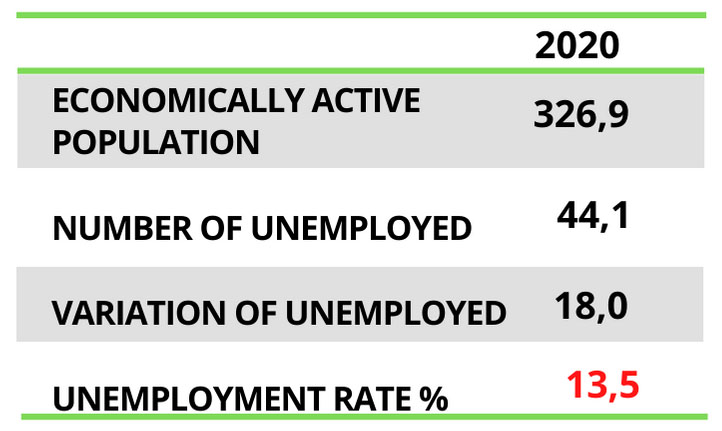

It is estimated that there will be an increase of 18 million unemployed people and ECLAC estimates that the average unemployment rate in Latin America will be 13.5%. In our opinion, this estimate is probably very conservative. In Costa Rica alone, the National Institute of Statistics and Census (INEC) reports, in July, 2020, 40% rate of open unemployment in poor households.

|

LATIN AMERICA: LABOR INDICATORS

(Millions of people)

Source: Economic Survey of Latin America the Caribbean (ELAC). Year 2020.

|

In 2019 the average poverty rate in Latin America, according to ECLAC, was 30.3% of the population. As an impact of the pandemic, in just one year, poverty will increase by 7.3%, equivalent to 15 years of decline. Translated into human terms, that will mean 231 million people in a state of poverty. On the other hand, extreme poverty would be set back by 10 years, reaching 15.6% of the population, in a tragic secenario of 96 million people without the capacity to meet their most basic needs for food, shelter, health, etc.

This critical scenario is the result of two impacts of the pandemic seen as a synergistic event: the decrease in economic activity and, as a result, the decrease in the capacity of governments to counteract the crisis with social program. The greatest impact of these two components of what we can call "syndemics" (interaction of the health and the social) is the worsening conditions of the most vulnerable strata of the population.

Particularly determining are the impacts on investment, on private and productive consumption, on the level of export of goods and services, all of which are decisive indicators of economic activity and of the welfare of people.

The investment that had a 14% fall in the financial crisis of 2008 is going to have a collapse of more than 20% this year. This drop in investment is reflected in a more dramatic way in the calculation, also probably conservative, of the closure of 2.7 million formal businesses throughout the region. This blow to investment will mean a corresponding decrease in the supply of jobs, while at the same time greater pressure towards future investments that will require fewer jobs.

LATIN AMERICA: INVESTMENT VARIATION RATE

(In percentages)

Source: Economic Commission for Latin America and the Caribbean (ECLAC), based on official figures.

Note: 2020 are projections.

|

On the other hand, the decline in household income and the incresase in the unemployment level will strongly reduce provate cosumption, which is a determinant of aggregate demand and a fundamental driver of investment and productive supply. Private consumption will fall by 9.5% in just one year.

LATIN AMERICA: RATE OF CHANGE IN PRIVATE CONSUMPTION

(Percentages)

Source: Economic Commission for Latin America and the Caribbean (ECLAC), based on official figures.

Note: 2020 are projections.

According to data from ECLAC, Costa Rica is positioned as a country that will see its GDP less affected, placing it with a fall of 5.5%, much less than that of 13% in Peru and 10.5% in Argentina. The average decline in GDP in Central America is -6.2% and the average for South America is -9.4%.

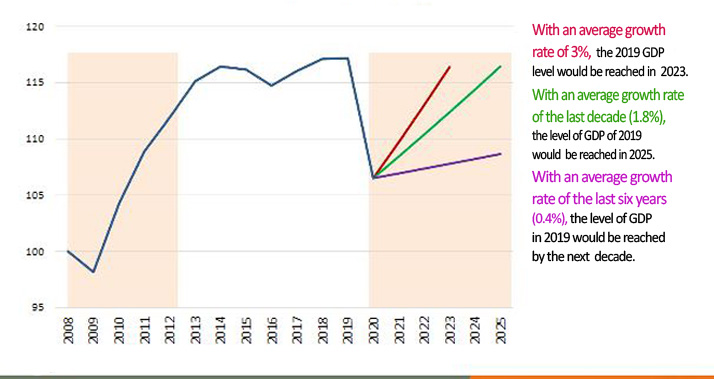

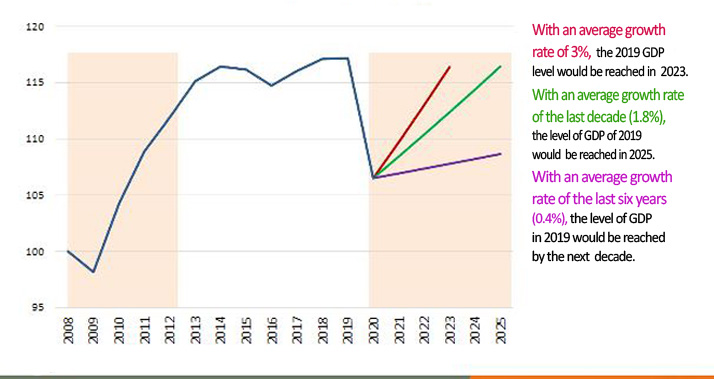

Assumptions for economic recovery in Latin America

- The first setting suggests a growth rate similar to that experienced after the subprime crisis of 2008. If lthere weresuch a recovery of an average rate of 3%, the level of production wealth (GDP) of 2019 would be reached in 2023.

- The second assumption is that the recovery will have the rate of 1.8% which was the average growth of the last decade (2010-2019). According to this projection, the GDP level of 2019 will only be reached in 2025.

- In this third model, the average post-pandemic growth rate is estimated to be similar to, if not lower than, the average growth rate of the past six years (0.4%). Recovery from the current level of national wealth would occur within 10 years ("lost decade").

LATIN AMERICA AND THE CARIBBEAN: LEVEL OF GDP IN REAL TERMS

(Index base 2008=100)

Source: Economic Survey of Latin America and the Caribbean (ELAC).Year 2020.

In any of these settings, the role of the State will play a leading role in the recovery. However, there are differentiated fiscal capacities among countries, which will limit or differentiate the State´s own capacities to drive economic growth. Expansionary fiscal policies have as their main constraint the general public debt after the 2008 crisis.

The pandemic changed the orientation of fiscal policy

Unlike Costa Rica, where the primary deficit had been growing since the subprime crisis, in Latin America an effort had been made to systematically reduce the primary deficit, reaching a Latin American average primary deficit of only 0.6% by 2016.

With the arrival of Covid-19, Latin American States were forced to resort to the public coffers to mitigate the social and economic effects of the pandemic.

|

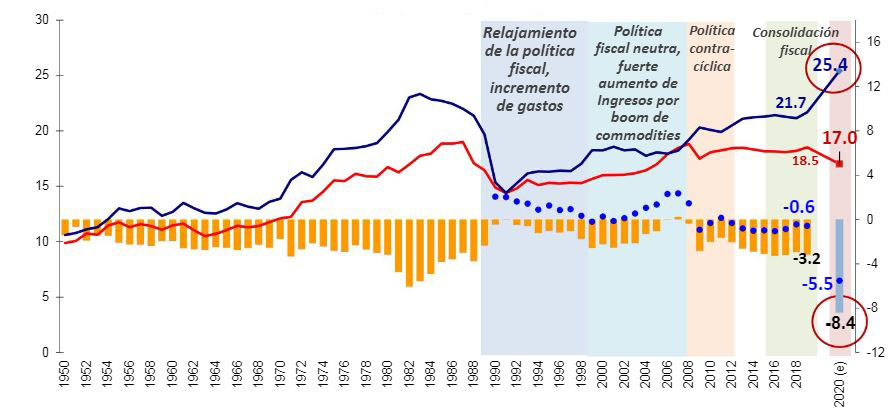

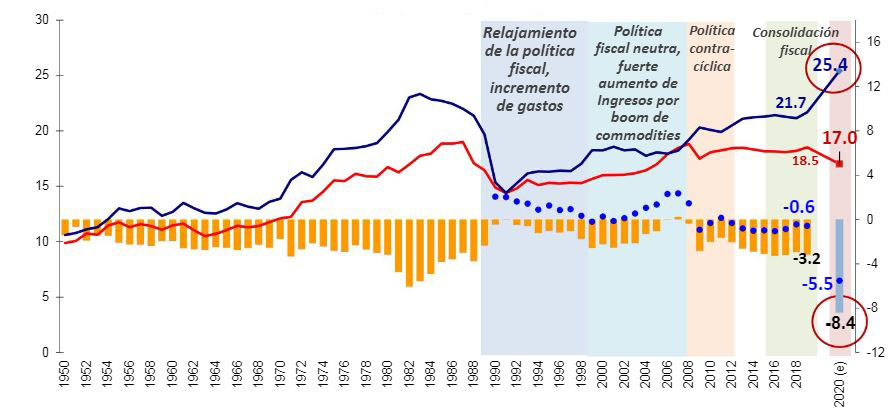

LATIN AMERICA (16 COUNTRIES): CENTRAL GOVERNMENT FISCAL INDICATORS,

1950 TO 2019 OBSERVED AND 2020 ESTIMATE

(In percentages of GDP)

|

Source: Economic Survey of Latin America and the Caribbean (ELAC).Year 2020.

The graph "Central Government Fiscal Indicators" shows the behavior of the public treasury in four major periods:

- Between the years 2000 and 2006, there was a period of economic expansion, which reached in Latin America, on average, an alignment between expenditures and revenues of the State, with a primary surplus.

- In 2008, on the occasion of the subprime crisis, Latin America adopted an anticyclical policy of expansion of public spending and stalled revenue and the gap between income and expenditure began to widen alarmingly and dangerously for democratic institutions.

- Between 2008-2019, a primary deficit is being produced, with a consequent increase in public debt. It is in this situation that Covid-19 finds Latin American countries.

- In 2020, during the pandemic and post-pandemic phase, the countries were forced to mitigate the impacts of the pandemic by increasing public spending by 25.4% of GDP. The decrease in economic activity produced a 17% drop in state income. Increased spending and decreased income caused a worsening of the primary deficit by 5.5% and, with it, a worsening of the public debt.

This is the discouraging panorama of the fiscal accounts, the Latin American States find themselves in need of stimulating the economy, while at the same time they must face their own debts, having less income due to the economic impact of the pandemic.

|

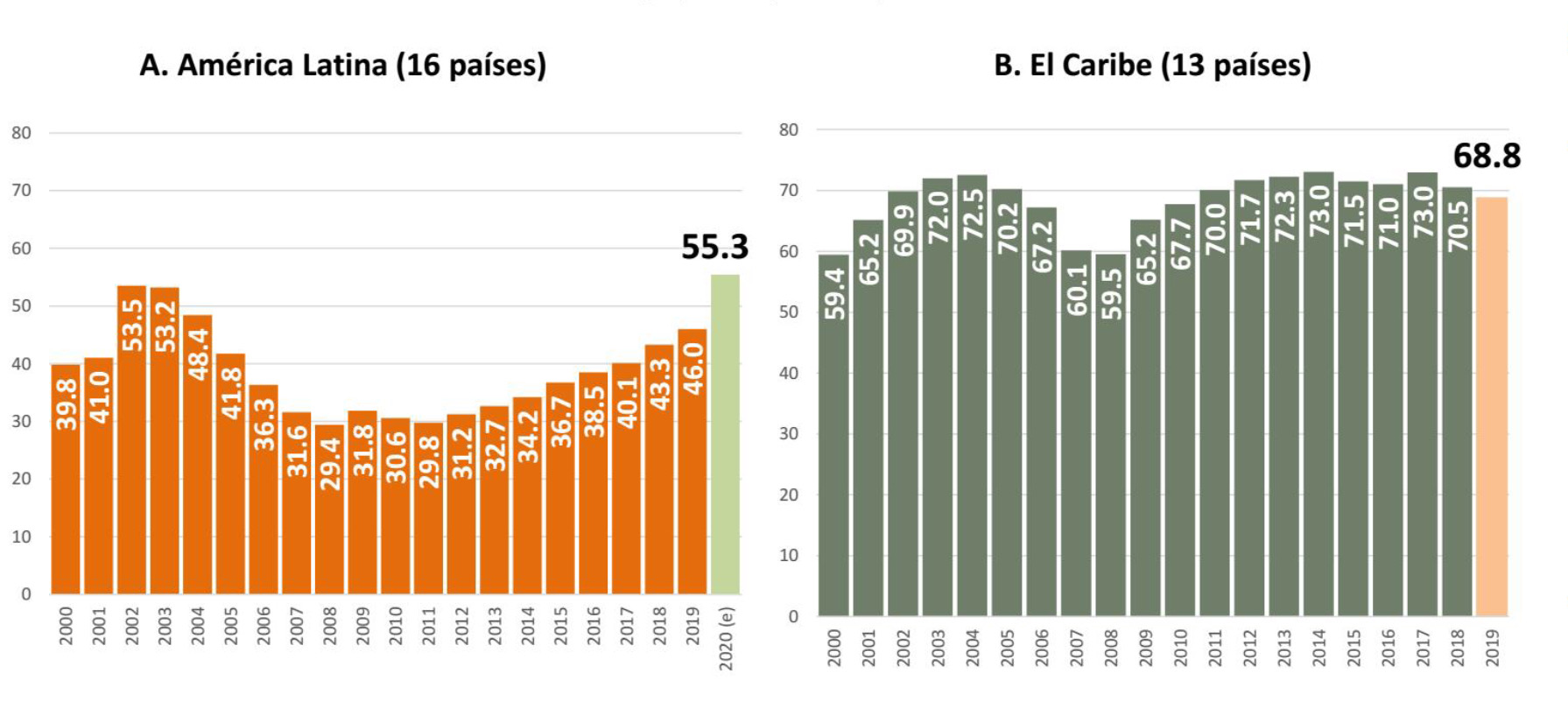

LATIN AMERICA AND THE CARIBBEAN: CENTRAL GOVERNMENT GROSS

PUBLIC DEBT, 2000-2019 OBSERVED AND 2020 ESTIMATED

(In percentages of GDP)

COMPARED TO DEVELOPED COUNTRIES, THE REGION HAS LOWER LEVELS OF DEBT

Source: Economic Commission for Latin America and the Caribbean (ECLAC), based on official figures. Note: 2020 are projections.

|

The graph on central government gross public debt shows this trend that we had noted both before and after the subprime crisis and at the time of the pandemic.

Since 2009, a curve of increasing public debt begins. But, since 2012, a decrease in the percentages of debt in relation to GDP has been observed in Latin America. These efforts, which did not take place in Costa Rica, were interrupted by the pandemic. Costa Rica was caught in an even more vulnerable situation.

The goal is to maintain an active fiscal policy in a context of lower tax revenues and higher indebtedness. Challenging situation.

Latin America is facing a triple challenge

On the one hand, Latin American States should (1) intervene with fiscal policies to support economic recovery, and likewise, they should (2) implement measures to mitigate the impacts of poverty by increasing their social spending. Furthermore, they should (3) carry out these active interventions in the economy, since, precisely because we are in a crisis of income and indebtedness, there are insufficient financial resources for points (1) and (2).

In order to face, simultaneously, the payment of their debt and to carry out their interventions in the economy, the Latin American States are forced:

- To resort to an increase in their indebtedness.

- To adopt structural transformations of their expenditures.

- Implement new income schemes (including taxes).

To maintain an expansive fiscal policy, a sustainability framework is required that focuses on income, that is, on the components linked to an improvement in tax collection. Measures related to:

- Eliminating areas of tax evasion and avoidance that reach 6.1% of the GDP.

- Strengthen tax collection:

- Consolidate income tax for individuals and corporations.

- Extend the scope of estate and property taxes.

- Establish taxes on the digital economy and corrective taxes: environnmental and those related to public health.

- Reorient tax expenditures towards the Sustainable Development Goals (SDA): 3.7% of GDP on average.

These challenges are posed by ECLAC based on a double framework, firstly by supporting fiscal sustainability focused on increasing state revenues.

Secondly, by orienting public spending towards economic reactivation. Active fiscal policy must link the short term (emergency) with the medium and long term. Similarly, it must direct public spending towards reactivation, economic transformation and addressing the social crisis aggravated by the pandemic.

In other words, the problem has three axes that must be addressed at the same time and that are grouped into three orders of supportive initiatives.

1. Demand - related support:

- Investment: labor-intensive and environmental sustainability projects.

- Sectors: infrastructure, transport, digital technologies and renewable energies.

- Household consumption: basic income for 200 million people in poverty.

2. Supply - side stimulus:

- Financing and liquidity for MSMEs: with longer terms and lower costs.

- Support of strategic sectors seriously affected.

- Fostering productive development, digital inclusión and the adoption of clean technologies.

3. Promotion of social inclusion:

Generalization of social protection systems: health, gender, pensions, education, unemployment insurance and universal basic income.

In Costa Rica, the national debate revolves around the restructuring of the State and fiscal improvement.

This are urgent actions, at the present time, but quite typical of the situation in which the other countries in the Latin American region find themselves.

Bibliography consulted:

|

|