MBA. Hellen Ruiz Hidalgo

Strategic Communicator, (OCEX-UNED)

Vice-Rectory of Research

Relevance of maritime transport in globalization. Since ancient times, maritime transport has been a crucial factor in international trade. However, under current conditions, its importance is strategic. To understand its contemporary relevance, it is useful to consider the drivers of globalized world trade since the 1990's.

Five major historical conditions have coincided to make globalization possible:

- Politically, the deciding factor for the unlimited expansion of trade was the occurrence of a peaceful and cooperative international environment, with the rule of international law. The Cold War was overcome, leaving behind the confrontation between opposing political and economic systems and facilitating the widespread acceptance of a single world economic system, whose monetary logic made it possible to expand trade and cooperation.

- In the regulatory sphere, this peaceful scenario also required each country to be willing to engage in open trade within a commonly accepted legal framework that would prevent and resolve conflicts. The World Trade Organization (WTO) served as a normative and regulated support for the open markets. The systematic reduction of tariffs allowed for a truly competitive exchange where the price of goods expressed the cost of producing them in each country, without protectionist distortions.

- In terms of technology, the Information and Communication Technologies (ICTs) revolution allowed for fluid and immediate relations, as well as for the construction of and access to databases on technologies, costs, demand and supply, which facilitated the knowledge of market scenarios under transparent exchange conditions.

- In terms of production and under the above conditions, the incorporation of the enormous volumes of Asian population, converted into labor, first from China and then, in an increasingly escalated manner, from the whole of Southeast Asia, allowed the delocalization of production throughout the world, seeking cost efficiency.

- In logistics, there was a revolution in maritime transport. After the oil crisis of 1974, with the purpose of reducing costs, gigantic ships were designed to be built and operated. Tanker ships, first, and later, container ships and also ships for dry grains. This reduced the transportation component in the price of products to such an extent that the geographical location of production became practically irrelevant in the determination of costs.

The latter is the critical role of maritime transport in the logistics of globalization.

The emergence of Global Value Chains. The reduction of tariffs, the cheaper transportation, the facilitation of low communication costs and the entry of China and Southeast Asia into the world economy, which provided abundant low-cost labor, transformed production into a global enterprise. From 1990 onwards, authors such as Thomas Friedman put forward the idea that the world had become flat. Distances between national borders mattered very little in terms of production and supply. (The Economist. 16/9/2021).

Under these conditions a most virtuous combination occurred: the synergy between Western industrial technological breakthroughs and Asian manufacturing muscle. The result was the hyperglobalization of supply chains. According to the Organization for Economic Cooperation and Development (OECD), 70% of world trade is conducted through increasingly complex global value chains (GVCs). The average foreign value added in domestic exports increased from less than 20% in 1990 to 30% or more in 2019, (OCDE. 2021).

The increased fragmentation of production between different countries makes trade flow statistics unreliable for assessing the value added of domestic production. Indeed, the GVCs force a multiple counting of trade in intermediate products because inputs cross  borders several times, in double tracks, according to the different stages of their transformative process. But that is also an indicator of extreme vulnerability: the interruption of a GVC link has a massive domino effect impact, with the difference that in dominoes to fallen dominoes cannot come back, again, the impact that in GVCs can be retroactive. (Fally, Thibault. 10/01/2012. Has production become more fragmented? International vs domestic perspectives-Vox/CEPR).

borders several times, in double tracks, according to the different stages of their transformative process. But that is also an indicator of extreme vulnerability: the interruption of a GVC link has a massive domino effect impact, with the difference that in dominoes to fallen dominoes cannot come back, again, the impact that in GVCs can be retroactive. (Fally, Thibault. 10/01/2012. Has production become more fragmented? International vs domestic perspectives-Vox/CEPR).

All of this is conditioned by the low cost of transportation exemplified by the added value of transportation in the price of a pair of sneakers. In 2019, the value of a 40-foot container from Shanghai to New York was $2500. In that container, 10,000 boxes of sneakers could be transported. Consequently, transportation added $0.25 cents to each pair of sneakers. On sneakers selling for $100, the value component of transportation would mean less than 0.25%. (Adapted 04/01/2020. Goetz Lisa. The Economics Behind Sneakers. Investopedia.)

Multinational corporations that previously kept all their manufacturing in their national headquarters have geographically segregated the stages of production, seeking low-cost labor and economies of scale on the other side of the world. Assuming that transportation of products or parts was easy, safe and inexpensive, companies adopted lean inventory management that facilitated greater efficiency and better cost control, under the assumption of "just-in-time" supply deliveries. The risk of supply disruption was minimal. Then came the Covid-19 pandemic.

Maritime logistics conditions in world trade. Maritime transport is responsible for the mobilization of 90% of world trade with more than 50,000 merchant ships. These are high-value vessels worth more than $200 million to build. Between 1968 and 2008, maritime transport quadrupled from 8 billion tons to more than 32 billion tons. Ocean freight rates are equivalent to 5% of the value of world trade. (UNCTAD - Review of maritime transport. 2020).

Container shipping has gradually become concentrated in the hands of a few companies. Five companies control almost 63% of the world's total shipping capacity. Between them and five other minor companies, 10 operators control 80% of the total mobilized, (see chart 1).

Chart 1. Top 10 container lines

Source: Own elaboration based on Alphaliner TOP 100 - Nov 2021.

Shipping in the face of changing market conditions. The operation of a large container ship has a large financial break-even point to cover. The construction period is two years. Both of these factors make the shipping industry very rigid and difficult to adapt to changes in market supply and demand conditions.

Prior to the 2008 financial crisis, demand for shipping had been growing. When Lehman Brothers collapsed, 60% of the entire fleet was on contract and suddenly market demand plummeted. That crisis took the shipping lines by surprise as they had been commissioning ships two years earlier to accommodate a demand that was growing 10% each year. The new fleet came on top of the old one just as economic growth contracted. Previous orders caused fleets to double, while demand fell by half.

One of the factors that caused the oversupply of shipping was competition between companies that had simultaneously increased their fleets. This caused supply to exceed demand as they operated in an uncoordinated manner, and the excessive maritime supply (ships) caused maritime transport prices to plummet. Shipping lines barely managed to meet their financial and operating costs. Container shipping learned a hard lesson: it is not affordable to get ahead of the market and end up with dangerous overcapacity.

Graph 1. World's largest container ports by performace

(In thousands of TEU)

Source: Own elaboration based on data from Marine Department (Hong Kong) - 2021.

Overcapacity has been dragging down profitability for years. Consulting firm McKinsey estimates that between 2012 and 2016 container shipping saw a loss of unrealized revenue expectation of $84 billion of shareholder value. (The Economist.10/10/2020. How covid-19 put wind in shipping companies' sails).

In the last five years, before the pandemic, the industry as a whole has barely recovered from overcapacity, hardly reaching a fragile equilibrium, with very, very low prices. And, most importantly, in the case at hand: they braced themselves against making the same mistakes in the next crisis and formed several alliances between the largest companies.

That sort of "shipping cartels" provides a system of coordination, sharing out routes and mostly coordinating a prudent and synchronized management of new shipbuilding. Already in April 2017 there were three major alliances: 2M Alliance (Maersk, MSC and HMM); Ocean Alliance (CMA CGM, COSCO, OOCL and Evergreen); and THE Alliance (K Line, Yang Ming, MOL, Hapag-Lloyd, NYK Line and UASC). (Solé Sans, Anna y Vidal Margalida. 2017. ¿Para qué sirven las alianzas de las navieras? Crónica Global). To this must be added the problem that maritime traffic means for global warming and the responsibilities that shipping companies will have to assume to comply with growing emissions reduction regulations.

Climate challenges for the shipping industry. International shipping is responsible for 2.5% of global greenhouse gas (GHG) emissions. In the European Union (EU), they account for 13% of total GHG emissions from the total transport sector, including land transport. Global shipping emissions are estimated to increase by 50% to 250% by 2050, making it difficult to meet the Paris Agreement targets. Therefore, the EU has put in place mandatory mitigation measures for seaborne trade departing from and/or arriving at EU ports.

In the European Union (EU), they account for 13% of total GHG emissions from the total transport sector, including land transport. Global shipping emissions are estimated to increase by 50% to 250% by 2050, making it difficult to meet the Paris Agreement targets. Therefore, the EU has put in place mandatory mitigation measures for seaborne trade departing from and/or arriving at EU ports.

To conform to those measures in a cost-effective way, there is significant unexploited potential: slow steaming, weather-dependent shipping routes, counter-rotating propellers and propulsion efficiency devices. All these actions offer fuel savings and lower GHG emissions, but require technologically adequate modern fleets. (European Comission. 2019. Reducing emissions from the shipping sector. Climate Action).

In April 2018, the International Maritime Organization (IMO) adopted Resolution MEPC.304(72). By 2050, its goal is to reduce GHG emissions by 50% from 2008 levels. It is estimated that meeting this target will require huge investments. In addition to taking out of service old ships that cannot adapt to the change, a new technologically adequate fleet is needed. Investments of up to 1.4 billion dollars in cleaner fuels and technologies are estimated. That is an annual investment of between $40 billion and $60 billion over the next 20 years. A total decarbonization of shipping would require an additional investment of $400 billion. The estimate is for a total investment of $1.9 billion, by 2050. (Allianz Global Corporate & Specialty. 15/07/2020. Climate challenges in the shipping industry).

All this will obviously have an impact on international shipping prices. That's why the first thing shipping companies did, in the midst of the pandemic crisis, was to get rid of old ships with obsolete technology and reduce their orders for new ships. All this lightened their overall cargo capacity in anticipation of a declining demand. They assumed that an economic recovery would come, but not when, how, or by how much. This time around, however, they would take advantage of better prices and not risk falling into the overcapacity they experienced after the 2008 financial crisis.

All this will obviously have an impact on international shipping prices. That's why the first thing shipping companies did, in the midst of the pandemic crisis, was to get rid of old ships with obsolete technology and reduce their orders for new ships. All this lightened their overall cargo capacity in anticipation of a declining demand. They assumed that an economic recovery would come, but not when, how, or by how much. This time around, however, they would take advantage of better prices and not risk falling into the overcapacity they experienced after the 2008 financial crisis.

One of the reasons why, when the long-awaited economic recovery came, it was met, at the same time, with a very low supply of container ships. In added to this, demand did not fall as much as expected either, and the shipping lines' cutbacks were excessive. Prices began to rise even before the current container ship crisis.

The impact of the Covid-19 pandemic on the global logistics crisis. The early impacts of the pandemic affected the normal functioning of the logistics chain. Sanitary restrictions caused major factories in China to halt production and some of its largest ports to close. All this with fleets of loaded ships on the oceans, lined up in front of closed ports. At destinations in Europe and the United States, there were also sanitary restrictions that interrupted the normal operation of loading, unloading, delivery and ordering of goods.

In this scenario, shipping companies took for granted a collapse of trade and, in order not to have idle capacity, reduced 11% of the world fleet. But the demand for trade did not decrease, but rather experienced an upturn. With the economic stimulus offered by both the Trump and Biden administrations over the pandemic, U.S. households increased their consumption.

In the first seven months of 2021, cargo volumes between Asia and North America increased 27% compared to pre-pandemic levels. Meanwhile, the container shipping fleet had declined in cargo capacity. With shipping supply 11% lower, freight rates began to rise.

Finally, there are the imponderables that play a role in the current chaos of shipping logistics, which ends up impacting freight costs:

- Increased delays of vessels, in loading and unloading movements in ports, due to the absence of qualified port workers,

- Loss of synchronization in ports between arrivals and departures of vessels,

- Uncoupling between containers that arrive full and have no return cargo, which generates empty containers,

- Incompatibility between planned destination ports that are closed and unplanned destinations that are turned to for unloading, resulting in a generalized disorder and shortage of containers,

- Additional difficulties in unloading port warehouses due to reduction of truck drivers and rail personnel,

- Factory closures in China due to sanitary restrictions,

- Floods in China, Europe and the United States that affected land and river transportation and thus supply chains,

- Collapse in the supply of semiconductors which, although not directly related to the pandemic, impacted the production of vehicles and electronic devices,

- Power outages in China due to rising coal prices, increased electricity demand and the strict application of GHG emission restriction standards.

All of the above resulted in a worldwide congestion in maritime traffic and an extraordinary spike in the cost of shipping.

The crisis of rising maritime costs. Shipping costs have risen sharply since 2020. The first few months of 2021 have seen a further price spike in the various freight rates.

An example from The Economist magazine puts it clearly: The average cost of shipping a standard large container (a 40-foot equivalent unit) has exceeded $10,000, four times more than a year ago. The price to ship such a container from Shanghai to New York in 2019 would have been $2,500; now it exceeds $15,000. Booking late on the busiest route, from China to the U.S. West Coast, could cost $20,000. (The Economist. 16/09/2021. A perfect storm for container shipping.)

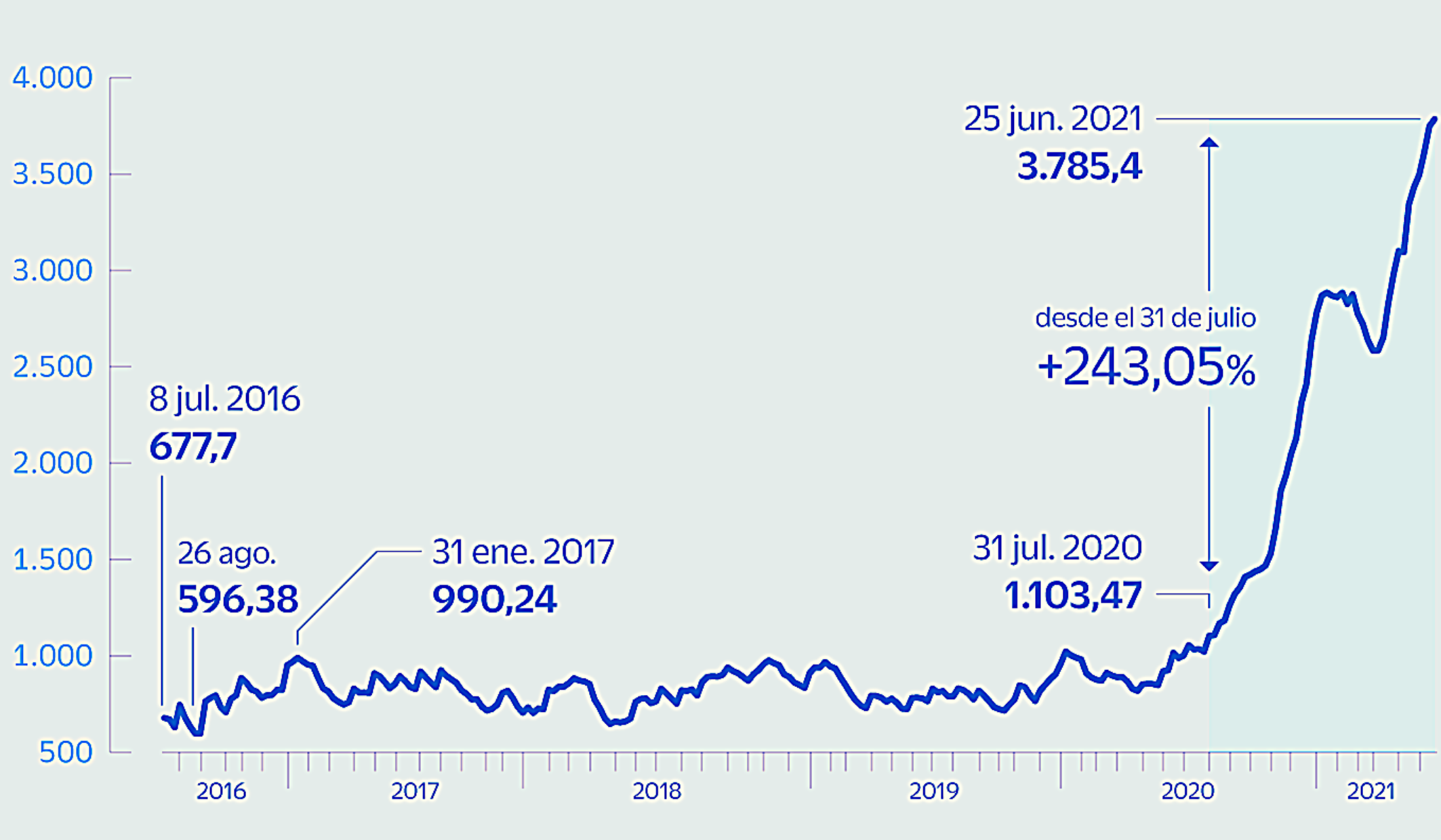

The following graph 2 is an average of costs for different routes and serves to better illustrate the global growth in shipping costs.

Graph 2. Seaborn freight from China, skyrocketing

(Average price in dollars to 20-foot container from Shanghái via the world's major shipping lanes)

Source: Own elaboration based on Bloomberg data - 2021.

The rigidity of shipping prices. The conditions described above make it very difficult to avoid high transportation costs for a long time. For larger products, shipping costs have a significant impact. This is not the case for smaller products, such as household goods, toys, etc. In these cases, freight costs represented only 5% of the total price, and became more than 20%. For small, high-value products, such as computers and semiconductors, alternative transportation options are an alternative, such as shipping electronic devices by air or rail, especially to Europe via the "Silk Road". But capacity is currently limited, and rates have also skyrocketed. The difficulty of absorbing increases of this scale in margins means that consumers may begin to feel the impacts through price increases or product availability crises.

Costa Rica: National status of the container shipping crisis. This perfect storm is already having an impact in Costa Rica, where it has had repercussions in the rise of freight rates and, therefore, this escalation may be passed on to consumers, as well as possible shortages of different kinds of products, due to the obstacles maritime transportation is experiencing.

In view of this situation, which would aggravate inflation and create a strong pressure on the national currency, the International Trade Commission of the Costa Rican Chamber of Commerce prepared, since March of this year, a proposal addressed to the government authorities with a plan to mitigate the impact of the high maritime cost due to the existing crisis.

It seeks to reduce the customs tax component in the price of goods entering the country. After several months, the proposals of the Costa Rican Chamber of Commerce, also supported by the Chamber of Foreign Trade (CRECEX) and the Chamber of Exporters (CADEXCO), have finally had, on November 6, 2021, an official response from the government:

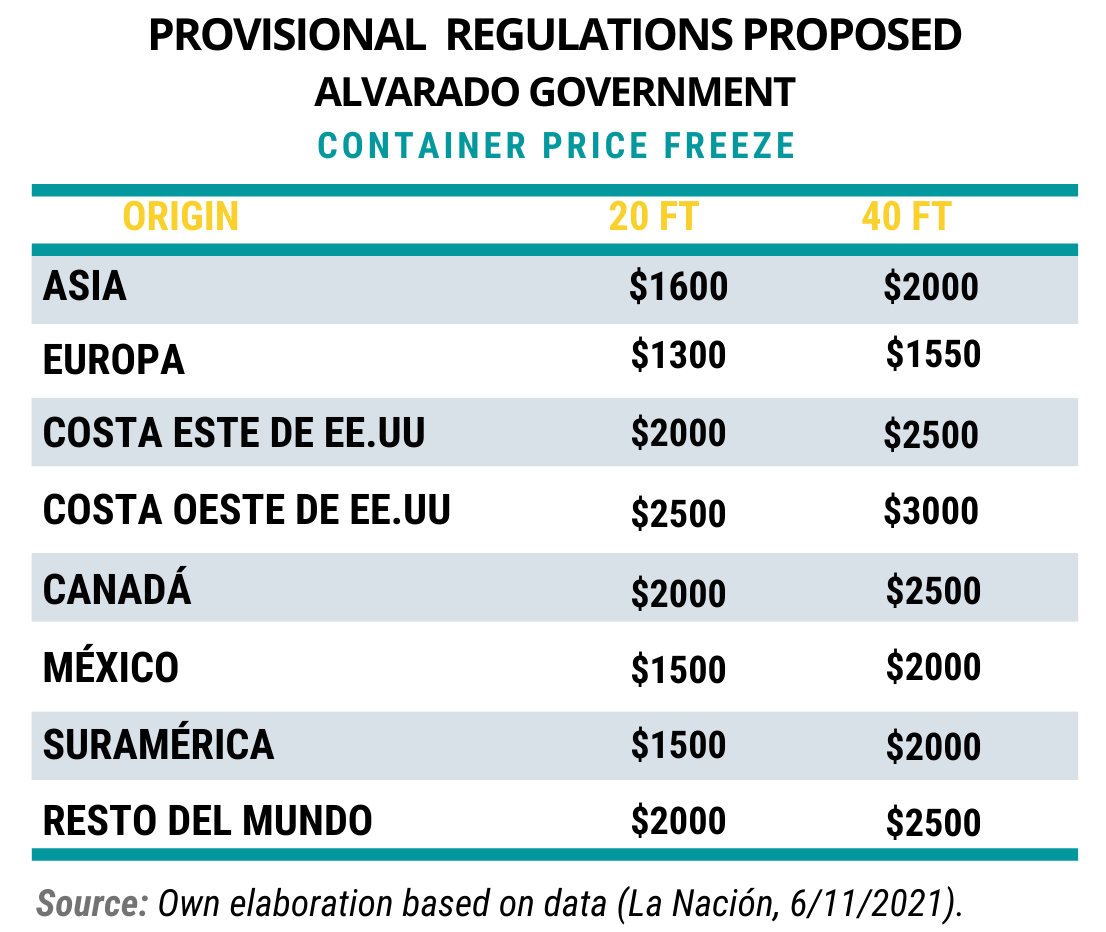

"The government of Carlos Alvarado announced a bill to mitigate the economic effect that the global container crisis is having on the import of goods. The idea is that, instead of calculating customs taxes on the value of the products plus the cost of maritime freight, which is currently reaching unprecedented amounts, the tribute will be calculated on the value of the merchandise plus a fixed transportation cost...". (La Nación, 6/11/2021)..

It is worth referring to the observations made by Mr. Andrés Valenciano, Minister of COMEX, as a representative of the government, who stated that Costa Rica cannot simply take a unilateral measure such as this one, since it is part of the Central American Customs Union, where it shares a unified customs code. This code has been negotiated and subscribed by Costa Rica and restricts the margins for Costa Rica to take customs decisions unilaterally.

It is worth referring to the observations made by Mr. Andrés Valenciano, Minister of COMEX, as a representative of the government, who stated that Costa Rica cannot simply take a unilateral measure such as this one, since it is part of the Central American Customs Union, where it shares a unified customs code. This code has been negotiated and subscribed by Costa Rica and restricts the margins for Costa Rica to take customs decisions unilaterally.

Valenciano had warned that the proposal should be submitted to the Council of Ministers of Economic Integration (COMIECO), whose mandate is to establish the economic integration policies of the region and whose pro-tempore presidency is currently held by Costa Rica.

The government seeks to freeze the freight tax, based on the average freight cost of 2019, the year prior to the pandemic. The objective of this measure is worthy because, by reducing the customs tax burden, it helps companies, often small and already battered by months of restricted economic activity.

It also benefits the pockets of consumers who, in the final analysis, would be recharged in the final prices the tariffs increased by the growing cost of freight.

The repercussions that unilateral measures could have at the regional level cannot be overlooked, however, as they jeopardize the consistency of the rules that Central American countries have agreed to comply with in order to uniformly levy tariffs on goods in all countries.

Tariff uniformity is lost both by a unilateral increase or decrease in tariff rates and by the unilateral establishment and application of rules or practices to determine the basis on which those rates are applied. One of these is determining the customs value of goods, regardless of their CIF cost.

It is therefore understood that the most appropriate way to do this should be within the context of a regional consensus. However, for the time being, the lobbying of the chambers of commerce seems to have been successful and, apparently, a consensus exists between the Executive and several forces in the Legislature to quickly approve the proposed law.

For more information on the impacts of the container crisis in Costa Rica, we share with you the interviews made to the different unions and actors of the public-private sector, in: Estado Nacional Program of Teletica channel 7. November 2021.

Readings consulted:

- La Nación.com. Carlos Alvarado propone congelar impuesto para mitigar crisis de contenedores. Noviembre de 2021. En: La Nación, 6/11/2021.

- Think.ing.com. Cinco razones de seguir aumentando los costos del transporte marítimo. 2021. En: https://think.ing.com/articles/the-rise-and-rise-of-global-shipping-costs/

- The Economist. Una tormenta perfecta para el transporte de contenedores ¿Las interrupciones prolongadas cambiarán el patrón de comercio? Septiembre de 2021. En: https://www.economist.com/finance-and-economics/a-perfect-storm-for-container-shipping/21804500

- BBC News Mundo. Crisis de los contenedores: ¿por qué hay tantos barcos haciendo fila para entrar a Estados Unidos? Octubre 2021. En:https://www.bbc.com/mundo/noticias-58943545

- Teletica.com. Estado Nacional: Crisis de contenedores ¿Qué medidas se pueden tomar para mitigar este impacto? Noviembre 2021. En: https://bit.ly/3ECxbRQ

- CEPAL. Logística Internacional Pospandemia: Análisis de la industria aérea y la de transporte marítimo de contenedores. 2020. En: https://www.cepal.org/sites/default/files/news/files/boletinmaritimo72_esp.pdf

- France 24.com. China sufre la peor escasez de energía de su historia reciente. Octubre 2 de

2021. En:https://www.france24.com/es/asia-pac%C3%ADfico/20211001-china-escasez-energia-cortes-carbon - UNCTAD: United Nations Conference on Trade and Development. Review of maritime transport. 2020. En: https://unctad.org/system/files/official-document/rmt2020_en.pdf

- El Financiero. EE.UU. dará servicio portuario de 24 horas para superar atrasos. Octubre 13 de 2021. En: https://www.elfinancierocr.com/economia-y-politica/ee-uu-dara-servicio-portuario-de-24-horas-para/TTD5XNAH5NH4ZH3674MUUXL2MQ/story/

- CentralAmericaData.com. ¿Crisis mundial en las cadenas de suministro? El COVID-19 y el cambio climático han impactado directamente las cadenas de suministro de los sectores e industrias que más derrama económica generan. Octubre 4 de 2021. En:https://m.centralamericadata.com/es/article/main/Crisis_mundial_en_las_cadenas_de_suministro?

- Business Insider. La crisis del transporte marítimo mundial continúa empeorando: las inundaciones en China y Europa son otro duro golpe para las cadenas de suministro a nivel global. Julio 27 de 2021. En: https://www.businessinsider.es/crisis-transporte-maritimo-mundial-continua-empeorando-905589

- BBC News Mundo. Canal de Suez: 4 razones por las que su bloqueo puede afectar al comercio mundial (y a tu bolsillo). Marzo 25 de 2021. En: https://www.bbc.com/mundo/noticias-56529362